Anti-bending Acrylic Latch Split Tablet Case for Funda IPad ケース Pro 12 9 Pulgadas 11 Air 1 2 3 4 5 Carcasa 9th 10th Generación - AliExpress

Funda IPad Air 1 2 Case for IPad 9.7" 2016 2017 2018 ipad Air 5 Air 4 2022 10.9 Smart Soft Case IPad 8th 9th 10.2 2020 Pro 11 - AliExpress

Funda IPad Air 1 2 Case for IPad Pro 9.7" 2016 2017 2018 ipad Air5 Air4 2022 10.9'' Case IPad 8th 9th 10.2 2020 Pro11 iPad 2 3 4 – Twosheep

Amazon.com: Puxicu - Funda para iPad 2 3 4 (modelo antiguo), funda protectora de TPU suave y flexible para tableta Apple iPad 2, iPad 3, iPad 4, transparente : Electrónica

Ipad Case Pencil Holder | Ipad 2 A1395 Case | Cover Ipad A1395 | Case Ipad A1396 - Ipad 2 3 - Aliexpress

Amazon.com: TopEsct funda de iPad para niños, funda de silicona a prueba de golpes y mica protectora de vidrio templado para Apple iPad 2, iPad 3, iPad 4, Azul : Electrónica

Amazon.com: Eoso, teclado para Apple iPad Air/Pro 9,7, con funda de piel, teclado extraíble, con Bluetooth, plegable, para iPad Air, iPad Air 2, iPad Pro 9.7 Tablet, iPad 2/3/4 negro : Electrónica

Shry For Ipad Air 5 Case 2022 Ipad Air 4 Case 2020 10.2 9th 8th Generation Case Funda Ipad Pro 11 Mini 6 5 10.5 Air 2 9.7 5 6th Cover | Fruugo NO

Funda IPad Air 1 2 Case for IPad Pro 9.7" 2016 2017 2018 ipad Air5 Air4 2022 10.9'' Case IPad 8th 9th 10.2 2020 Pro11 iPad 2 3 4 – Twosheep

Amazon.com: Funda para iPad de 4ª generación 2012 (modelo antiguo de hace 11 años) de 9.7 pulgadas, funda para iPad de 3ª generación 2012, funda para iPad 2 2011, soporte giratorio con

Ipad Mini 6 Generation Case | Pro Case Ipad 6 Generation | Fundas Ipad 6 Generation - Tablets & E-books Case - Aliexpress

For iPad air 1 2 9.7 2017 2018 Case Silicone Soft Back Smart Cover Funda Case for iPad A1474 A1475 9.7 5th 6th Case Coque Capa - AliExpress

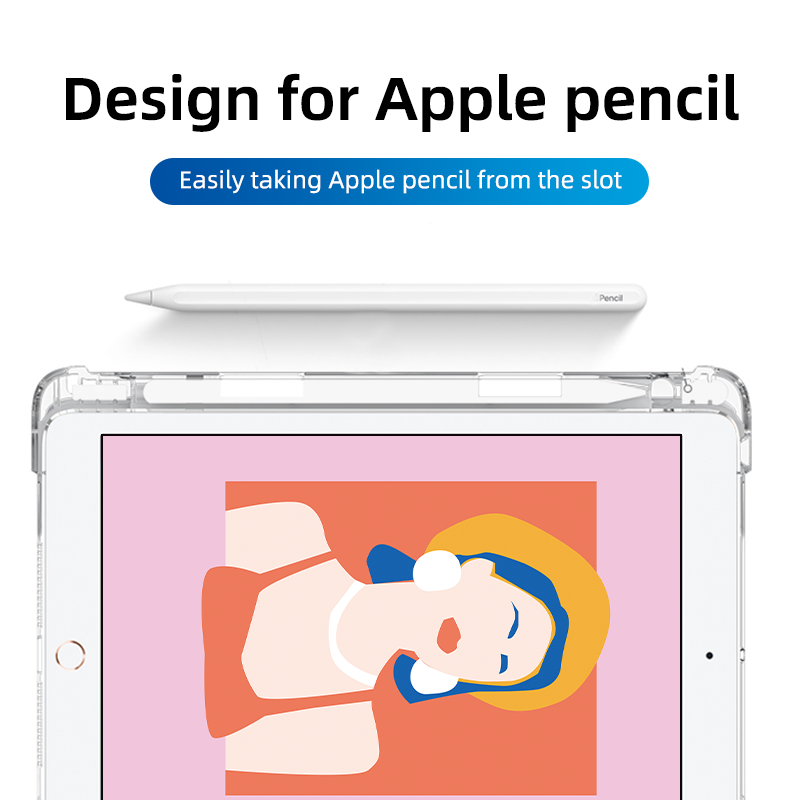

For iPad Pro 11 Case 2020 iPad Air 4 Case 2021 Pro 12.9 Funda iPad 10th Generation Case 10.2 Cover 2022 Air 5 Mini 6 Pencil Case - AliExpress

Hansong iPad case iPad Pro 11in 2nd 3rd 4th Gen iPad 10.2 7th 8th 9th Gen 5th 6th Air 4th 5th 10.9 10th Mini 6 PU Silicon Cover

Funda IPad Air 1 2 Case for IPad Pro 9.7" 2016 2017 2018 ipad Air5 Air4 2022 10.9'' Case IPad 8th 9th 10.2 2020 Pro11 iPad 2 3 4 – Twosheep

Amazon.com: AICase - Funda para iPad 2, iPad 3, iPad 4, a prueba de golpes, resistente, resistente a los impactos, híbrida, de tres capas, con lápiz capacitivo para iPad 2/3/4 (negro/rosa) : Electrónica

Amazon.com: AVAWO Funda para iPad 2, 3, 4 generación, modelo antiguo, protector de pantalla integrado, soporte de mango a prueba de golpes, apto para niños, compatible con iPad de 2ª 3ª 4ª

Amazon.com: iPad funda de transporte con correa para el hombro de 9,7 pulgadas Pro, Air 1, Air 2, 2017 iPad 9,7 pulgadas. Por orden innovativecareusa. Com profesional Rugged Durable Funda para iPad.